Last week a few important macroeconomic reports were released. In Canada retail sales and CPI were in the limelight. Retail sales decreased sharply, which signaled economic weakness. CPI fell again, annual rates of growth made only 0.9%. Core CPI resumed uptrend, annual rates of growth made 1.8%. Economy is still weak, inflationary pressure is moderate. If current tendencies remain valid, BoC may start cutting the rates in 2007.

BOJ minutes release was the only significant data on the Japanese economy. The minutes remained almost unchanged. BOJ may keep raising rates, it will depend on current economic data.

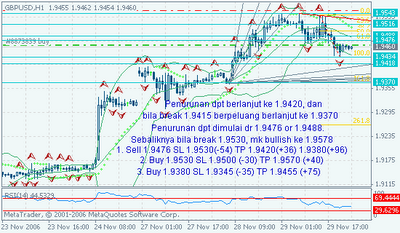

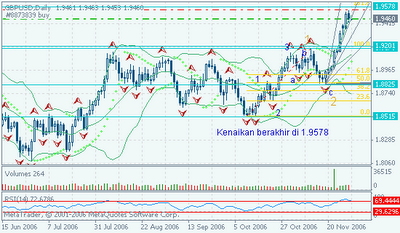

As for Great Britain BOE minutes were in the limelight. There were 7 voices from 9 to raise the rates. The minutes were quite dovish, which signals that further rates hikes are hardly probable. Further rates hikes should not be expected, as there are no objective reasons to raise the rates. GDP growth is steady, annual rates of growth make 2.8%. Economic rates of growth are positive, though some deviations in economy bear risks. Industrial production is still weak. Inflationary pressure decrease is observed, though inflation is still high. BOE may tighten monetary policy to get additional data.

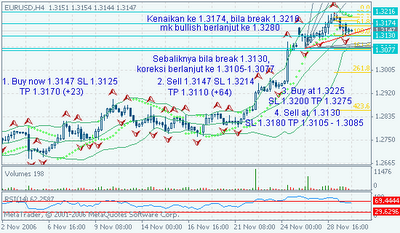

As for economy of the Euro zone IFO data was in the limelight. The indicator increased sharply to 106.8. Economic situation is still positive. Economic growth continues, inflationary pressure is moderate on energy resources prices decrease. Trade balance data were positive, the deficit decreased sharply. ECB may raise the rate again in December, then there will be a pause in the circle of rates hikes as inflationary pressure steadied.

As for the US economy, no important data were released. Leading indicators showed positive dynamics and increased in October. Consumer Sentiment (UM) was revised down, it is still at high levels. Economic growth is slowing down, though some stabilization can be noticed. The housing market bears the main risks for the US economy.

Liquidity decreased on holidays, which triggered strong currency fluctuations at low volumes. USD fell sharply on low liquidity, breakout of important technical levels. USD index reached this year lows, further decline will strengthen negative sentiments towards the dollar. Risks of USD further drop are still high.

This week will be rich in important data. In Canada GDP and unemployment data will be in the limelight. Economic rates of growth slowed a bit in 2006. Further slowdown would be a negative signal. Canadian labor market normalized, after sharp fluctuations of unemployment rate the indicator steadied around 6.2%. Unemployment rate reduction would be positive. Economic situation is still unclear in Canada, risks of economic growth slowdown are still valid, rates hikes become less probable in the mid-term perspective.

Economic reports will be in the limelight in Japan. Retail Sales and Industrial Production for September were weak, that is why October data will be important. As BOJ has decided that interest rates hikes will depend on economic data, negative reports will postpone the date of further rates hikes. Inflationary data should be paid attention to, inflation pressure increase may trigger rates increase by 0.25 basis points already in December.

In Great Britain BOE head's speech will be in the limelight. He will probably speak about expected decrease of inflation pressure, in case it is highlighted, it will signal that BOE is not going to raise the rates anymore. Economic growth steadied in GB, economic risks consist in the fact that increase is formed mainly by the real estate market. Any negative tendencies in this market will have negative impact on economic growth. There are no grounds for further rates hikes yet.

As for the Euro zone economy, GDP data for the 3rd quarter and preliminary inflationary data for November will be in the limelight. Economic growth is balanced, it may keep stabilizing. Inflationary pressure decreased, which makes rates hikes in the first half of 2007 less probable. Inflationary pressure may keep steading around 2.0% in the nearest future. It is highly probable that ECB will raise the rates to 3.5%, its further measures will depend on current economic data and forecasts. That is why OECD forecasts release on Tuesday should be paid attention to.

As for the US economy a series of important macroeconomic data will be released. Revision of GDP rates of growth in the 3rd quarter should be paid attention to. Economic growth slowed down mainly on negative tendencies in the real estated data. Last data on New Housing starts were extremely negative, that is why information on selling in the real estate market may have a strong impact on the markets. Existing and New Home Sales for October will be released. Further slowdown in this market will press USD.

Special attention should be paid to Ben Bernanke's speeches on Tuesday and Friday. Any negative evaluation of current economic situation will be treated as a signal of possible rates cuts already in the first half of 2007. Though inflationary pressure is still high, dynamics of inflationary decrease may remain valid, whereas grave doubts arise on economic rates of growth.

Risks of USD decline are still high, current situation signals USD downtrend resumption.